Here at SANY New York, we know there are many ways to get you in a SANY machine. While some folks prefer to buy their heavy equipment outright, financing is very common in this field. If you’re new to financing or to the industry, there are some major differences between financing in other sectors and financing heavy machinery. But if you’re worrying, relax! We’ve put together a few things to know that will help you in your decision.

There are several differences between heavy equipment financing and personal lending. One of the biggest differences in financing heavy machines is the effect of one’s personal credit. For personal loans, financing is heavily dependent on the buyer’s credit score. But if your credit isn’t the greatest, don’t worry – personal credit doesn’t necessarily affect heavy machinery financing, especially if you can prove that your business generates reliable revenue. Why? Your equipment will serve as your collateral, which will make creditors feel more comfortable in their decisions. Your business’ credit could affect the amount of your financing options, however, but a down payment can make up for that.

Could you get a loan from any old bank? Well, technically you could, but smaller lenders will scrutinize your credit more, which could be problematic if your credit score is low. If that’s the case, the interest rate might be high. They may also take longer to come back to you with an offer, too. Another drawback is that the length of the lending term could be longer than what’s typically offered in the industry, meaning that more interest will accrue over time, and you’ll be out more money.

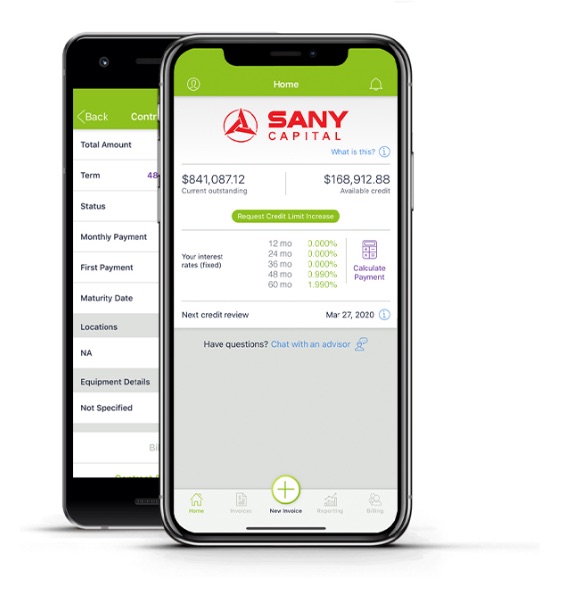

When it comes to financing SANY machines, we have solutions that will avoid the issues you might face at a private bank. Our SANY Capital program makes it quick and easy for you to secure and customize your heavy equipment financing to fit your specific situation and needs. On our website, we even have a calculator that lets you crunch the numbers and see how different interest rates, terms and down payment amounts affect your options. For qualified buyers and machines, SANY Capital may even finance 100% of your purchase. This includes attachments, taxes, maintenance agreements and even delivery. By doing so, rather than saving up for a down payment, your funds can be freed up and used elsewhere in your business.

When it comes to financing SANY machines, we have solutions that will avoid the issues you might face at a private bank. Our SANY Capital program makes it quick and easy for you to secure and customize your heavy equipment financing to fit your specific situation and needs. On our website, we even have a calculator that lets you crunch the numbers and see how different interest rates, terms and down payment amounts affect your options. For qualified buyers and machines, SANY Capital may even finance 100% of your purchase. This includes attachments, taxes, maintenance agreements and even delivery. By doing so, rather than saving up for a down payment, your funds can be freed up and used elsewhere in your business.

The road to financing heavy equipment might seem like a bumpy one, but that doesn’t mean we can’t smooth the way for you to get your own fully loaded machine out of your dreams and onto the jobsite. We hope this article will give you more insight on this process. Know that we’re here to help every step of the way. If you’d like to contact us about pricing and financing, you can do so by visiting our Financing page or by contacting us directly.